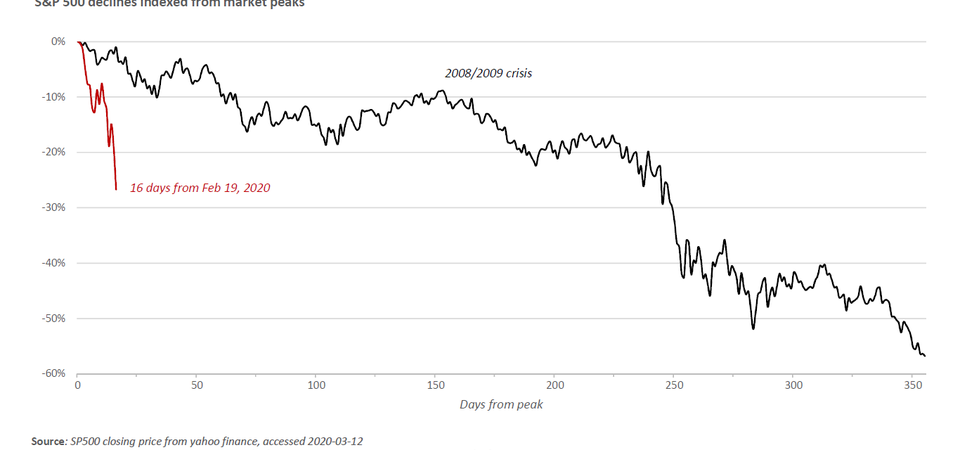

There was a lot of talk about the recession during the past few years. Central banks have exhausted their monetary measures and trade wars between large economies meant lower growth rates for the world as a whole. Economic analysis of unfavorable yield curves suggested a potential recession in the near future even before Covid19 struck. Now, most countries are desperately fighting to contain the global pandemic through lockdowns and suspensions of their industries. That only contributes to making the recession not only a possibility but a certain scenario. A Reddit user u/atomofconsumption probably best illustrated that point with his chart:

From what it seems, this stock market crash is only the tip of the iceberg. As unemployment skyrockets in countries around the world, the potential for economic downfall seems to be unavoidable. Some sources say it will be as bad as the Great Depression, if not worse. So, it's not surprising that many businesses, especially those in the hospitality industry, are wondering:

How to pull through this crisis?

It turns out, data science might be a huge help in this regard. Big data is an umbrella term for a vast pool of (usually unstructured) data that people are creating in an increasingly digitalized world. It ranges from tweets, SMS messages, comments, reviews, personal info and virtually every information made public by people. Companies can then employ data mining to extract from their valuable economic information.

For example, a sudden surge of tweets regarding job losses in Northern Europe can be a pretty good indicator of a relatively bad tourist season in southern Europe. As more and more people lose their income they are less likely to go on a vacation in the Mediterranean. And that is bad news for people in the tourist industry of Southern Europe. The discovery of the usefulness of big data research since 2008. have led to boosts in entire industries related to data mining and processing with impressive results.

As covid19 is disrupting the tourism and hospitality industry, the focus is on data that can be used to determine it's future. It turns out, review data can be surprisingly useful in that regard.

Photo by Austin Distel on Unsplash

Using review data

We already know that there is a high correlation between the stock value of a company and their reviews. Tracking the reviews of various companies over time can be an important indicator of their success in the stock market. Even more important, in times of an economic crisis, accurately measuring the real and expected value of a company is tremendously important when assessing their future performance. As weird as it may sound, a recession can be a great investment opportunity. It represents a great time to invest in cheap stocks of realistically valuable brands. They're the ones most likely to survive and turn high profits in the future.

Analyzing review data is, therefore, a crucial step in making investment plans in the tourism and hospitality industry. Assessing review values, review counts and the general sentiments towards various companies is crucial in making investment decisions.

Acquiring data

There are many services promising to do just that but they are rarely flexible and straightforward in that regard. Any company seeking to fetch data for their review analysis should make sure it's reliable and easy to use and that's where services like justLikeAPI truly shine. By providing a structured JSON response it enables data science companies to crunch large amounts of review data. It also has the benefit of being flexible and offering custom solutions to those wanting more so it's really easy to get started with using it.

Even though a recession is highly probable in the next 12 months it doesn't mean that individuals and companies cannot use unfavorable economic conditions to thrive. They just have to be smart about it and rely on innovative data analysis techniques to get ahead.